SAP SD (Sales and Distribution) TUTORIALS

SAP SD ( Sales and Distribution ) is one the largest functional Module in SAP.It handles all the processes from an Order to delivery.The main operations this module handles are Customer Sales Orders processing , pricing, Picking, packing , Shipping, billing and risk management etc.

SAP SD Discussion Forum and Sales/Distribution Tips

Document Flow in Sales

Basic Process of how Packing Works

Accumulate the amount of condition types in accounting document

Add a Field To New Condition Table in Pricing

For example:

Material 4711 costs 150 USD. Some customers receive a discount of 10 USD per 100 pieces.

However, a specific customer can buy the material for 100 USD. Since this is a particularly good price, the customer should not also have a discount of 10 USD per 100 pieces. Therefore, this discount is to be excluded from pricing.

To achieve this, copy the standard pricing to a ZXXXX Pricing.

Define new document pricing procedure in SM30 - V_TVKV for billing.

Assign new document pricing procedures to billing types in SM30 - V_TVFK_PR

Define the Condition Exclusion Groups in OV31.

Assign the Condition type for the Condition Exclusion Groups in OV32.

Assign the Billing Pricing Procedure in VOK8 for the Condition Exclusion Groups.

This is how it should look after modification:

* Header data

* VBRK-xxxxx = ............

* Item data

* VBRP-xxxxx = ............

* Additional split criteria

System response

FI documents have a 3-digit item counter that limits the number of items permitted per document.

If the documents with an excessive number of items come from another application area

(e.g. sales, logistics, order accounting), you can configure the system to the effect that

these documents are summarized in FI. "

SAP SD Discussion Forum and Sales/Distribution Tips

Listed here are practical and helpful SAP SD Stuff to assist those supporting the SAP Sales and Distribution Module. You can find samples of interviews questions, answers and faq as well as many other tips for the SAP SD module. If you have any SAP Sales and Distribution questions, please feel free to raise it in the SAP SD forum.

The Sales and Distribution (SD) application component fulfills many of the international requirements that supports the sales and distribution activities with functions such as pricing and conditions, customer order processing, delivery monitoring, billing, credit and risk management.

Document Flow in Sales

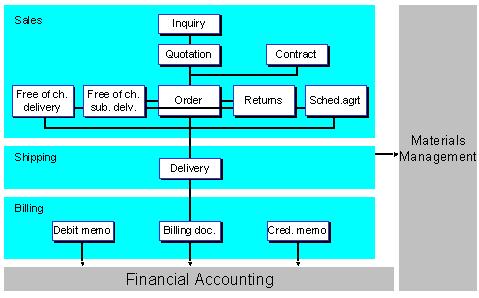

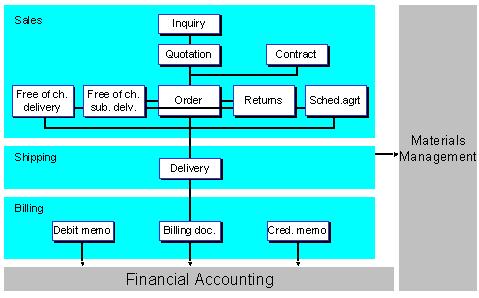

The sales documents you create are individual documents but they can also form part of a chain of inter-related documents. For example, you may record a customer’s telephone inquiry in the system. The customer next requests a quotation, which you then create by referring to the inquiry. The customer later places an order on the basis of the quotation and you create a sales order with reference to the quotation. You ship the goods and bill the customer. After delivery of the goods, the customer claims credit for some damaged goods and you create a free-of-charge delivery with reference to the sales order. The entire chain of documents – the inquiry, the quotation, the sales order, the delivery, the invoice, and the subsequent delivery free of charge – creates a document flow or history. The flow of data from one document into another reduces manual activity and makes problem resolution easier. Inquiry and quotation management in the Sales Information System help you to plan and control your sales.

The following graphic shows how the various types of sales documents are inter-related and how data subsequently flows into shipping and billing documents.

The following graphic shows how the various types of sales documents are inter-related and how data subsequently flows into shipping and billing documents.

Basic Process of how Packing Works

Let's say you want to pack a material shirt_jai in test_pack.

Using MM01, create material type=packaging test_pack

[SPRO]

IMG-Logistics Execution-Shipping-Packing-

Define Packaging Material Types

Let's say JPAC. The settings that I chose:

Plant determ. - Plant is entered manually in handling unit

Pack. matl. cat. - Packaging materials

Generate Dlv. Items - blank

Number assignment - Number range interval 'HU_VEKP'

IMG-Logistics Execution-Shipping-Packing-

Define Packaging Material Types

Let's say JPAC. The settings that I chose:

Plant determ. - Plant is entered manually in handling unit

Pack. matl. cat. - Packaging materials

Generate Dlv. Items - blank

Number assignment - Number range interval 'HU_VEKP'

IMG-Logistics Execution-Shipping-Packing-

Define material group for packaging material

Let's say JGRP

Define material group for packaging material

Let's say JGRP

IMG-Logistics Execution-Shipping-Packing-

Define allowed packaging materials

JGRP - JPAC

Define allowed packaging materials

JGRP - JPAC

MM02: Check settings for the materials

First, test_pack

First, test_pack

Sales:General/Plant -> Matl. Grp. Pack. Matls: JGRP (Note)

Sales:General/Plant -> Packaging Mat. Type: JPAC (Note)

Basic Data 1 -> Material: JMAT

Sales:General/Plant -> Packaging Mat. Type: JPAC (Note)

Basic Data 1 -> Material: JMAT

Then, shirt_jai

Sales:General/Plant -> Matl. Grp. Pack. Matls: JGRP

Sales:General/Plant -> Packaging Mat. Type: -

Basic Data 1 -> Material: JMAT

Sales:General/Plant -> Packaging Mat. Type: -

Basic Data 1 -> Material: JMAT

VL01N Outbound Delivery -> Packing

Enter the materials at top and at bottom

Enter the materials at top and at bottom

The "Packing Process" with an Example

Example:

You created a order for a material(R-1160 - hard disks) for a qty - 120 pieces.

You created a order for a material(R-1160 - hard disks) for a qty - 120 pieces.

You need to create a delivery and

A)pack 40 pieces each of the material are grouped together into larger cardboard boxes (PK-100 - shipping/packing material) and

B)these 3 cardboard boxes are put into pallet (PK-095).

A)pack 40 pieces each of the material are grouped together into larger cardboard boxes (PK-100 - shipping/packing material) and

B)these 3 cardboard boxes are put into pallet (PK-095).

Solution:

A)Packing 40 pieces each of material (40 x 3 = 120 pieces)

A)Packing 40 pieces each of material (40 x 3 = 120 pieces)

1)Goto [VL02N] to change the delivery, you already created.

Or you can do the following steps while you are creating a delivery also.

2)Go to "pack" icon.

3)In the upper section, enter the "packing material" (PK-100)

4)In the lower section, change the "partial quantity" to 40 of material R-1160.

5)Select both the lines of upper section and lower section and click the green ok. It generates a shipping unit/handling unit number.

6)Now, select both lines of upper & lower section & click the button "per part. qty" (New HU per part qty of material)

Check: click "General Overview" icon to see whether it packed 40 pieces of material in 3 cartons.

Or you can do the following steps while you are creating a delivery also.

2)Go to "pack" icon.

3)In the upper section, enter the "packing material" (PK-100)

4)In the lower section, change the "partial quantity" to 40 of material R-1160.

5)Select both the lines of upper section and lower section and click the green ok. It generates a shipping unit/handling unit number.

6)Now, select both lines of upper & lower section & click the button "per part. qty" (New HU per part qty of material)

Check: click "General Overview" icon to see whether it packed 40 pieces of material in 3 cartons.

B)Packing all 3 cartons in one big carton(PK-095)

1) from above screen, click "pack HUs" (pack shipping unit)

2)enter the packaging material (PK-095) in the upper section and select this line.

3)select 3 lines of PK-100 in lower section since you want to pack them in PK-095.

4)selecting both lines, click "pack" icon.

5)Now all the 3 cartons(PK-100 with 40 pieces each of material) are packed in one big carton (PK-095).

Check: "General overview" icon.

2)enter the packaging material (PK-095) in the upper section and select this line.

3)select 3 lines of PK-100 in lower section since you want to pack them in PK-095.

4)selecting both lines, click "pack" icon.

5)Now all the 3 cartons(PK-100 with 40 pieces each of material) are packed in one big carton (PK-095).

Check: "General overview" icon.

Finance

Difference between Condition Type

Please explain the difference between Ek01 ( Actual Cost) and EK02 Calculated Cost.

These are the condition type that will display the results of the unit costing for certain type of sales document.

EK01 :

If you use this condition type, the result of unit costing is issued to the first position on the conditions screen for the item. The value can be used as a basis for price determination.

If you use this condition type, the result of unit costing is issued to the first position on the conditions screen for the item. The value can be used as a basis for price determination.

EK02:

If you use this condition type, the result of unit costing is simply a statistical value which you can compare with the price.

If you use this condition type, the result of unit costing is simply a statistical value which you can compare with the price.

Please note the following points :

1) The condition type must have condition category 'Q' (costing).

2) The condition type must agree with the condition type defined for unit costing in the pricing procedure.

I have a customer who is being offered two discounts ie k007 and k005, now I want to exclude k007 for the next 2

orders or so? I have set the exclusion indicator for the condition type,but still the condition is being accepted when I create a sales order. Am I missing something, how do I do it?

orders or so? I have set the exclusion indicator for the condition type,but still the condition is being accepted when I create a sales order. Am I missing something, how do I do it?

I think u need to change the validity of the condition record for the condition type K007 defining it not valid for that particular 2 months. And also the settings of the Requirements as it is correct that it overrules the exclusion.

Accumulate the amount of condition types in accounting document

To accumulate the amount of condition types in accounting document without affecting the pricing display in billing document.

As an illustration :-

ZPXX 3500

ZDXX 1000-

ZWXX 500-

ZDXX 1000-

ZWXX 500-

(all condition types are shown separately in pricing view)

Journal:

Dr Vendor 2000

Cr Sales 2000 (ZPXX - ZDXX - ZWXX)

Dr Vendor 2000

Cr Sales 2000 (ZPXX - ZDXX - ZWXX)

One way to do it is :-

Mark the condition types you want to group as statistical and remove the account assignment key.

Create a subtotal in your pricing procedure that will add them together and put in the account assignment key for it. This way the individual components will still display on your pricing screen but FI will only get one posting.

Creating New Pricing Procedure

What is the transaction code for creating new pricing procedure and how to attach it to specific plant?

You create PP in spro > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define and Assign Pricing Procedures > Maintain Pricing Procedures

You can't attach PP to specific plant. Pricing Procedure is determined thru trx OVKK. The defining parameters for pricing procedure determination are:

1. SalesOrg

2. Distribution Channel

3. Division

4. Document Procedure (defined in Sales doc\Billing doc maintenance)

5. Pricing procedure assigned to customer (defined in customer master)

2. Distribution Channel

3. Division

4. Document Procedure (defined in Sales doc\Billing doc maintenance)

5. Pricing procedure assigned to customer (defined in customer master)

Reg pricing procedure.

1. Use transaction code v/07 to create a access sequence and assign tables based on which you want to carry on

pricing as accesses.

pricing as accesses.

2. Use transaction code v/06 to define condition type. It can be for base price, discount, freight etc.,

(Do assign relevant access sequence)

(Do assign relevant access sequence)

3. Use transaction code v/08 to define pricing procedure.

4. Assign this to your relevant sales area+ dpp+cupp.

While specifying requirement, we can give reqt no.22 which specifies that plant has to be set. This is generally done for output taxes since output taxes depend upon the delivering plant. But directly there is no assignment between plant and pricing procedure.

What is "alt cal type" & "alt base value" & "Requirement field" in the Pricing Procedure

Can any one explain exactly what is "alt cal type" & "alt base value" and also " Requirement field" in the pricing procedure?

The alternate base value is used as the calculation basis only, while the alternate calculation is used to modify the final value.

For example, imagine you have a condition type ZZ01, with a condition record maintained (master data) for $100. Now, condition ZZ02 also exists lower in the schema, but with a rate of 10%. The standard calculation would result in a final value of $110.

The alternate base value could say, "don't use $100 as the basis -- use the original price PR00 only, which was $90." Then, the final value would be $100 + (10% of $90) = $109.

The alternate calculation routine says, "ignore the 10% altogether. Instead, use an externally calculated 20%." Then, you end up with a final value of $100 + (20% of $100) = $120.

Put them both together, and you could end up with $100 + (20% of $90) = $118.

Now once again,

Alternative Calculation Type:

Normally if you want to calculate a value you have to use a calculation type for determinating the value. This calculation type is either addition, subtraction or multiplication. Similarly SAP also has got a default calculation type in the control data of the condition type. There you have the options of either Qty based , Fixed Amount Based or Percentage based.

Here what happens is suppose if you define Your condition type that calculates the base price of a material on Qty based. Then the calculation will be done based on the quantity of the material. If the customer orders 10 Nos and you have maintained a unit price of 100 Rs for each material then the value determined is 1000 INR. Similarly if the discount condition type , you maintain the calculation type as %. This means if you maintain the value of 10 % in the condition record. Then this percentage is taken as the calculation type and the condition value is determined.

In some cases you have to forego the default calculation types and use the customer specific method for calculating a value. For ex if you are calculating the Freight charges for a Material . it depends on so many criteria like, the weight, volume and also the minimum amount etc etc, in those cases, you forego the default value and then use the alternative calculation type in calculating the condition value against the particular condition.

Alternative Condition Base value :

If you have to calculate any value then you have to have a base value for it. For ex if you want to calculate the discount of 10 % for a material then you have to have a base value on which this 10% is calculated. Normally you take the condition value of the base price of the material to calculate the value.

Now you don't want to take the base value and take other values as base value which are derived on some formulae. So you create a routine which will do the mathematical operations in the routine and derive you a value which is now used as the base value for calculating the condition value for a particular condition type.

Requirement:

A factor in the condition technique that restricts access to a condition table. The system only accesses a condition table to determine the price if the requirement specified has been met.

A factor in the condition technique that restricts access to a condition table. The system only accesses a condition table to determine the price if the requirement specified has been met.

Example:

The system uses an access sequence to determine the price of a material. One of the accesses in the sequence contains the requirement "in foreign currency." The system only uses the table behind this access if the sales order for which the price must be calculated is in a foreign currency.

Pricing date based on Deliv. date, Sales Ord, Billing

How can I, or am I able to find anything on a way of RE-Pricing be done in a QUOTATION?

You can always 'Update" pricing manually in a quotation the same way you do in a sales order, either in create or change modes. Menu path Edit --> New Pricing or press the 'Update pricing' button on the item conditions tab.

If you are asking how to reprice a quotation when it converts into a sales order, that can be done with the copy controls of the Item Category. IMG: Sales & Dist --> Sales --> --> Maintain Copy Control for Sales Docs --> Sales Doc to Sales Doc (transaction vtaa). Just choose the combination of documents and the respective item category. The field you need to be concerned with is "Pricing type".

However, from a business process perspective it makes absolutely NO sense to reprice a quotation when converting to a sales order. After all, the entire point of using quotations is to firm up details like pricing before creating the sales order.

Quantity Based Discounts in Bulk Quantities Sales

You're looking to implement quantity based discounts in 4.6c. You are trying to sell items in specific bulk quantities, and only give the discount for specific quantity intervals.

For example, if a customer orders 1 piece, 2 pieces, 3, etc. of part ABC, the price is $100.

If the customer orders 10 pieces of part ABC, the price is $50.

However, this is not only a standard minimum quantity discount. If the customer tries to order 11 pieces, 12, 13, etc. it should return $100 again.

The only values for which $50 should apply are 10, 20, 30, etc. - multiples of the bulk quantity 10.

You have discussed changing your part number to reflect a bulk qty of 10, however you have in house consumption that is allowed to consume only 1 part at a time. You would vastly prefer to keep one part number that you order from the supplier, consume internally and ship externally.

You are fairly certain there is basic functionality that covers this, but you're just not sure where to start.

Taking your requirements literally. Standard SAP scale pricing will not do it in that you only want the reduced price to come into effect when the order quantity is multiple of some bulk factor.

It is agreed with that creating a separate material number is not a good idea.

You can try this :-

1. Define/Select a UOM for selling in bulk (i.e. cas, pallet, box whatever)

2. Maintain UOM conversion between your base UOM and this new UOM

3. Configure you bulk pricing condition type by usual means (it should be a base price rather than discount).

4. Place this new bulk price behind your normal "PR00" price in the pricing procedure

5. Create a new condition base value routine via VOFM where you check XKWERT to see if it is a whole number. If it is not then set XKWERT to zero.

6. Assign this new routine to your bulk price condition in your pricing procedure in ALT condition base value column.

2. Maintain UOM conversion between your base UOM and this new UOM

3. Configure you bulk pricing condition type by usual means (it should be a base price rather than discount).

4. Place this new bulk price behind your normal "PR00" price in the pricing procedure

5. Create a new condition base value routine via VOFM where you check XKWERT to see if it is a whole number. If it is not then set XKWERT to zero.

6. Assign this new routine to your bulk price condition in your pricing procedure in ALT condition base value column.

7. Maintain bulk price conditon record in the Bulk UOM.

Mass Update of condition pricing

You can update the condition pricing for a range of sales order.

For e.g. if you create sales order for 15 months or so, and at the beginning of each year, you have to update the prices for lots of sales orders.

Other than using VA02 and make an Update of the conditions at item level which is a big work because you will have lots of open sales order after so many months.

Use VA05, select your Orders and on the result screen :-

Make Material Master Price of a material as sales price automatically

The first method is not to set the pricing condition VPRS as statistical.

Simply remove PR00 and it will work fine if you always use VPRS as your pricing base inside the pricing procedure.

VPRS will reads both prices based on the price control in the material master.

Price control S for standard price.

Price control V for moving average price.

Price control V for moving average price.

It is this simple if you do not have any other "Prices" in the price procedure.

However, if you are using one pricing procedure where for some items you price using VPRS and some others using PR00, then you should use requirement routines to enable the correct price condition type at the right time.

The second method involves more work as you need to write a formula (VOFM) to get that information.

This is how it goes :-

1. Set VPRS to be the first step in the pricing procedure and to be subtotal B (as standard).

2. Set PR00 with alt. calc. type formula, which sets the value of PR00 to be equal to the subtotal B.

The routine (created with transaction VOFM) is:

The routine (created with transaction VOFM) is:

RV64A901

FORM FRM_KONDI_WERT_600.

XKWERT = KOMP-WAVWR.

ENDFORM.

FORM FRM_KONDI_WERT_600.

XKWERT = KOMP-WAVWR.

ENDFORM.

The pricing procedure than looks like that:

Step 1 VPRS statistical, subtotal B, reqt 4

Steps to Create Commission for Agent

For creating commission agent, you have to follow below steps.

1) Establish Partner Functions for the Commissionee(s)

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

2) Assign the Partner Functions to Partner Procedures

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

3) Create a Partner Procedure for the Commissionees

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

4) Create New Customer Account Group(s) for Commission Agents

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; LOGISTICS GENERAL ->; LOGISTICS BASIC DATA: BUSINESS PARTNERS ->; CUSTOMERS ->; CONTROL ->; DEFINE ACCOUNT GROUPS AND FIELD SELECTION FOR CUSTOMER

Transaction Code: OVT0

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; LOGISTICS GENERAL ->; LOGISTICS BASIC DATA: BUSINESS PARTNERS ->; CUSTOMERS ->; CONTROL ->; DEFINE ACCOUNT GROUPS AND FIELD SELECTION FOR CUSTOMER

Transaction Code: OVT0

5) Assign the Partner Functions to the Customer Account Group(s)

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS ->; GOTO ->; PARTNER FUNCTIONS ->; ENVIRONMENT ->; ACCOUNT GROUP ASSIGNMENT

Transaction Code: VOPA

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS ->; GOTO ->; PARTNER FUNCTIONS ->; ENVIRONMENT ->; ACCOUNT GROUP ASSIGNMENT

Transaction Code: VOPA

6) Assign the Partner Functions to the Partner Procedure for the Sales Document Header

Menu Path: Tools ->; Business Engineer ->; Customizing ->; Sales and Distribution ->; Basic Functions ->; Partner Determination ->; Define Partner Functions

Transaction Code: VOPA

Menu Path: Tools ->; Business Engineer ->; Customizing ->; Sales and Distribution ->; Basic Functions ->; Partner Determination ->; Define Partner Functions

Transaction Code: VOPA

7) Assign the Partner Functions to the Partner Procedure for the Sales Document Item (OPTIONAL)

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PARTNER DETERMINATION ->; DEFINE PARTNER FUNCTIONS

Transaction Code: VOPA

8) Edit the Pricing Communication Structure (KOMKAZ) to Hold the New Functions (Client Independent)

Menu Path: Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; DICTIONARY

Transaction Code: SE11

Menu Path: Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; DICTIONARY

Transaction Code: SE11

9) Edit MV45AFZZ – userexit_pricing_prepare_tkomk (Client Independent)

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Transaction Code: SE38

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Transaction Code: SE38

10) Edit RV60AFZZ - userexit_pricing_prepare_tkomk (Client Independent)

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Transaction Code: SE38

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Transaction Code: SE38

11) Edit MV45AFZB - userexit_new_pricing_vbkd changing new_pricing (Client Independent)

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Transaction Code: SE38

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Transaction Code: SE38

The following code should be inserted into program MV45AFZZ to allow the system to re-execute pricing if the user makes a change to the relevant partner function (alteration, addition, deletion).

13) Add the KOMKAZ Fields to the Pricing Field Catalog (Client Independent)

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE ACCESS SEQUENCES ->; MAINTAIN ACCESS SEQUENCES

Transaction Code: OV24

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE ACCESS SEQUENCES ->; MAINTAIN ACCESS SEQUENCES

Transaction Code: OV24

14) Create Condition Tables (Client Independent)

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE ACCESS SEQUENCES ->; MAINTAIN ACCESS SEQUENCES

Transaction Code: V/03

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE ACCESS SEQUENCES ->; MAINTAIN ACCESS SEQUENCES

Transaction Code: V/03

15) Create an access sequence containing the new tables (Client Independent)

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE ACCESS SEQUENCES ->; MAINTAIN ACCESS SEQUENCES

Transaction Code: V/07

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE ACCESS SEQUENCES ->; MAINTAIN ACCESS SEQUENCES

Transaction Code: V/07

16) Create a new condition type

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE CONDITION TYPES ->; MAINTAIN CONDITION TYPES

Transaction Code: V/06

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE CONDITION TYPES ->; MAINTAIN CONDITION TYPES

Transaction Code: V/06

17) Add the Condition Type to the Pricing Procedure

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE AND ASSIGN PRICING PROCEDURES ->; MAINTAIN PRICING PROCEDURES

Transaction Code: V/08

Menu Path: TOOLS ->; BUSINESS ENGINEER ->; CUSTOMIZING ->; SALES AND DISTRIBUTION ->; BASIC FUNCTIONS ->; PRICING ->; PRICING CONTROL ->; DEFINE AND ASSIGN PRICING PROCEDURES ->; MAINTAIN PRICING PROCEDURES

Transaction Code: V/08

11) Create Commsission Report ZZCOMMISSION (Client Independent)

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Menu Path: TOOLS ->; ABAP WORKBENCH ->; DEVELOPMENT ->; ABAP EDITOR

Transaction Code: SE38

SD Questions About Pricing Condition

The Most Important Tips in Pricing For SAP SD Module to crack interviews...

Whenever we define our pricing procedures, we remain least interested in creating our own Condition Types,Condition

Tables & Access Sequences. What we do is, we just define our own pricing procedures by using the existing condition types (i.e: PR00, K004, K007, KA02, KF00 etc.) & then assign that Pricing Procedure with " Sales Area, Document Pricing Procedure & Customer Pricing Procedure " .

Tables & Access Sequences. What we do is, we just define our own pricing procedures by using the existing condition types (i.e: PR00, K004, K007, KA02, KF00 etc.) & then assign that Pricing Procedure with " Sales Area, Document Pricing Procedure & Customer Pricing Procedure " .

After that we put the values against each Condition Types, mentioned in our Pricing Procedure by using the T-Code "VK11". But we also need to know about the Condition Tables, Condition Types & Access Sequence Creation. So for that purpose we have to use the following T-Codes respectively : "V/05", "V/06" & "V/07". Now it will become easy to create the same.

What is the difference of VK11 and VK31 (condition records)?

My condition type is PR00 and Access sequence is PR02. And in this access sequence table 304 is available. Now when I was entering the PR00 in VK31 it shows error Table 304 is not defining for the condition type PR02. But when I was entering the PR00 at VK11 it is accepting it.

Difference between VK11 and VK31 - if you go through the menu path you will get the vk 31 as condition record from the tamplets whereas vk11 as simple condition record. In VK11 you can store condition record for more than one condition

type. This means you can have same condition record for different condition types.This feature is given to enhance the system's performane and not to create the duplcation of the work for each condition type.

Again system is not allowing to store the record in the vk31 for the condition type pr00 and access sequence pr02.This is because if you see this ac seq cointains two accessses 20 and 30 having the same table no.But you see there is the difference between the technical view of it for transfering the data from document field and condition field,so you can not maintain the data at VK31.

type. This means you can have same condition record for different condition types.This feature is given to enhance the system's performane and not to create the duplcation of the work for each condition type.

Again system is not allowing to store the record in the vk31 for the condition type pr00 and access sequence pr02.This is because if you see this ac seq cointains two accessses 20 and 30 having the same table no.But you see there is the difference between the technical view of it for transfering the data from document field and condition field,so you can not maintain the data at VK31.

What is the difference between Header condition and Item condition? I know item condition applies to each item in a sales document. Header condition can only be applied to an entire document.

Difference between header and item condition - as YOU CORRECTLY SAID HEADER CONDITION IS APPLICABLE FOR THE WHOLE DOCUMENT where as item is for item.Ex-Say fright is dependent on the total weight of all the items in the documents then header condition adds on weights of all items and calculates the record accordingly.

You have two different types of the header conditions.

a) In one you can duplicate the same value throughout the document for each item.Say discount 2% at header level which is also applicable to all the items

b)Second is the accumulation of the values of all the item at the header level,as earlier explained for the weight/fright.

These differenes are controlled through the indicator of group condition in the cond.type configuration.

You have two different types of the header conditions.

a) In one you can duplicate the same value throughout the document for each item.Say discount 2% at header level which is also applicable to all the items

b)Second is the accumulation of the values of all the item at the header level,as earlier explained for the weight/fright.

These differenes are controlled through the indicator of group condition in the cond.type configuration.

And so obviously header condition can not have the condition record and hence access sequence.

1. Requirement: Denoted by nos and maintained in VOFM, this is a condition required for a particular condition type to be executed. Eg. PR00: req 2 ie item relevant for pricing

VPRS/EKO1: req 4 ie cost

Rebate BAO1 Req 24/Req 25 etc

VPRS/EKO1: req 4 ie cost

Rebate BAO1 Req 24/Req 25 etc

2. Subtotal: this represents where a which table a value is stored, which can be processed for further calculation.

Eg. for PR00, if this value is to be used for credt check of a customer, we mark the subtotal as A.

3 Alternate Calculation type: this is also denoted by numbers and maintained in VOFM. Eg. Suppose for 45 units , each unit is charged $100 per unit, the order value comes out to be $4500, that is calculation is done as per unit price, if the client wants calculation type to be based on volume or wieght, alternate calculation type can be configured.

4. Alternate base value: Denoted by no. and maintained in VOFM.

Eg, if the pricing scale is maintained and pricing for 45 units comes under the scale of $100 per unit., the base value is 45 units, but if the client wants a standard base value in some casesto be assumed inspite of maintaining the scale, an alternate base value is confihured, that is the base value based on which the order value is to be calculated changes.

5. Accruals: Accruals are maintained for rebate agreements, it constitutes the total accumulated value which customer has earned through rebate, one the rebate for certain amount is settled the amount from the accruals get deducted.

Add a field to a new condition table in Pricing (Condition Technique):-

I will explain you the process with below example...Please follow steps in below sequence-

Try to add the filed from the field catalog. In case the required combination field is not there, you can add the field through the following process to filed catalog and create the condition table. It is most common that one or other time we need to use this function while configuring multi tasking & complex Pricing Architecture.

Here I'm giving a simple guide to add fields to the Pricing Field Catalogues:

For example you want to use field PSTYV ('Sales document item category') that is included in structure KOMP ('Pricing Communication Item') as a key for a condition table.

When you create a condition table (Transaction V/03), however, the system does not propose the field in the field catalog.

Condition access, field catalog, allowed fields, KOMG, KOMK, KOMP, KOMPAZ, KOMKAZ, PSTYV are the other terms which we need to know about, to add Fields.

Reason and Prerequisites:

For technical reasons, field PSTYV was included in structure KOMP, however, not in structure KOMG ('Allowed Fields for Condition Structures').

For technical reasons, field PSTYV was included in structure KOMP, however, not in structure KOMG ('Allowed Fields for Condition Structures').

Proceed as follows:

1. Call up the ABAP Dictionary (Transaction SE11) and create data type ZZPSTYV. Choose PSTYV as a domain.As a short text, you can use, for example, 'ZZ - sales document item category' and as a field label, you can use the field labels of PSTYV.Save, check and activate your entries.

1. Call up the ABAP Dictionary (Transaction SE11) and create data type ZZPSTYV. Choose PSTYV as a domain.As a short text, you can use, for example, 'ZZ - sales document item category' and as a field label, you can use the field labels of PSTYV.Save, check and activate your entries.

2. Call up structure KOMPAZ in the ABAP Dictionary (Transaction SE11) in the change mode and make the following entry:

Component Component type:

ZZPSTYV ZZPSTYV

Save, check and activate the change you made.

Component Component type:

ZZPSTYV ZZPSTYV

Save, check and activate the change you made.

3. Note:Because of the change in structure KOMPAZ, field ZZPSTYV is now known in structures KOMG and KOMP because structure KOMPAZ is included in both structures.

4. Call up Transaction SPRO. Navigate to 'Sales and Distribution -> Basic Functions -> Pricing -> Pricing Control' and execute 'Define Condition Tables'.

Choose 'Conditions: Allowed fields' and include ZZPSTYV as a new entry.

Choose 'Conditions: Allowed fields' and include ZZPSTYV as a new entry.

5. Note:Now you can use field ZZPSTYV as a key field when you create a condition table Axxx.

6. Supply the new field you defined by including the following source code line in USEREXIT_PRICING_PREPARE_TKOMP:

MOVE xxxx-PSTYV TO TKOMP-ZZPSTYV.

In order processing you find the user exit in Include MV45AFZZ, and in billing document processing you find it in Include RV60AFZZ.

MOVE xxxx-PSTYV TO TKOMP-ZZPSTYV.

In order processing you find the user exit in Include MV45AFZZ, and in billing document processing you find it in Include RV60AFZZ.

Consider that you can also use this note as a help if you want to use other customer-specific fields as key fields in a condition table.

For header fields, use structure KOMKAZ instead of structure KOMPAZ and

USEREXIT_PRICING_PREPARE_TKOMK instead of

USEREXIT_PRICING_PREPARE_TKOMK instead of

USEREXIT_PRICING_PREPARE_TKOMP.

What are header conditions?

Header conditions are those which appear in the header level of any sales order. these conditions are to be entered manually and get distributed automatically and the basis for distribution are taken from the NET VALUE of items mentioned at item level.

When we go to the conditions section in a sales order, where the details of pricing is mentioned, here we add these conditions.

Whenever any Header Condition is used, it overrides the PR00 condition type.

Examples of header condition.

- HA00 - % Based Header Condition.

- RB00 - Absolute or numeric value which applies to all items.

- HB00 - Numeric value or Absolute value.

What is the difference between group condition and header condition?

Group Condition: You can use this is feature of a condition type to apply price or discount for a material based on common property.

Header Condition: This is a manual condition which you apply to header (Condition screen) of a sales document. This amount is applicable to all items.

Header Condition: This is a manual condition which you apply to header (Condition screen) of a sales document. This amount is applicable to all items.

Usage of this feature is to apply price / discount for a specific group of materials.

1. You maintained a discount based condition record fbased on material group ( = 01 for example). You maintained scales also.

Qty Discount

1 - 10 Rs. 100.00

11 - 50 Rs. 105.00

51 - 150 Rs. 110.00 etc.

Qty Discount

1 - 10 Rs. 100.00

11 - 50 Rs. 105.00

51 - 150 Rs. 110.00 etc.

2. You are creating a sales order for a customer with five different items with different quantities as below

ITEM 1 - 25 No's

ITEM 2 - 3 No's

ITEM 3 - 12 No's

ITEM 4 - 27 No's

ITEM 5 - 62 No's

ITEM 2 - 3 No's

ITEM 3 - 12 No's

ITEM 4 - 27 No's

ITEM 5 - 62 No's

All the material is having the material group = 01.

3. While calculating the discount, because of this group condition, system add the quantities of items which have material group = 01. In the above example total quantity is = 109. System apply a discount of Rs. 110.00 to each item irrespective of the individual quantities.

4. If you have not activated the group condition feature, system determines the discount value based on individual item quantity which is as below.

Discount

ITEM 1 - 25 No's Rs. 105.00

ITEM 2 - 3 No's Rs. 100.00

ITEM 3 - 12 No's Rs. 105.00

ITEM 4 - 27 No's Rs. 105.00

ITEM 5 - 62 No's Rs. 115.00

Discount

ITEM 1 - 25 No's Rs. 105.00

ITEM 2 - 3 No's Rs. 100.00

ITEM 3 - 12 No's Rs. 105.00

ITEM 4 - 27 No's Rs. 105.00

ITEM 5 - 62 No's Rs. 115.00

5. Is it clear now. Just try a sales order and see the out come

Procedure to Test:

1. Create 3 materials. Maintain Material Group of each item is same.

2. Activate the condition type as a group condition.

3. Create a condition record for this condition type with scales.

4. Process a sales order for a customer with these three material with different quantities.

1. Create 3 materials. Maintain Material Group of each item is same.

2. Activate the condition type as a group condition.

3. Create a condition record for this condition type with scales.

4. Process a sales order for a customer with these three material with different quantities.

5. Check the outcome.

Billing cannot be Release to Accounting This SAP message will appear if the system is unable to find the G/L codes match from the configuration in transaction VKOA

No account is specified in item 0000001001

Message no. F5 670

Message no. F5 670

Diagnosis

No account was specified for account type "S" in item "0000001001" of the FI/CO document.

No account was specified for account type "S" in item "0000001001" of the FI/CO document.

System Response

The Financial Accounting program cannot process the document.

The Financial Accounting program cannot process the document.

Procedure

A system error has probably occurred in the application you called up. Check the data transferred to item "0000001001" of the FI/CO document.

A system error has probably occurred in the application you called up. Check the data transferred to item "0000001001" of the FI/CO document.

Assuming that one of the key combination is Account Assignment Group, you will have to check whether have the Account Assignment Group been input in the Customer Master (Billing tabstrips - Accounting sections - Field name: Acct assgmt group).

The Account Assignment Group will be copied automatically into the sales order.

Check whether the configuration in transaction VKOA have been done correctly.

Check whether the sales order (VA03 - Goto - Header - Financial Accounting - Field name: AcctAssgGr) have been filled in automatically.

Check whether the billing document (VF03 - Goto - Header - Header - Field name: AcctAssgGr) have been filled in automatically.

If the customer master have not been maintained and the user have already input the sales order, then the user will have to maintained the Account Assignment Group manually either in the sales order or the billing documents.

Take note for One Time Customer, the user have to input the Account Assignment Group manually into the sales order. One Time Customer can be used by many customer, therefore, the system will not be able to determine the Account Assignment Group manually.

Default Start Variant for VF04

There are two types of variant in VF04.

One is the selection variant before clicking the Display Billing List Button.

You can set the start variant via SE93 using the Change mode.

The second variant is the Billing Layout display variant.

This is after clicking the Display Billing List Button.

After creating your layout display variant, you can set it by clicking :-

Settings ->

Display Variant

-> Administration

Display Variant

-> Administration

Select the layout display variant you want and click :-

Edit ->

Define default settings

Condition Exclusion which will be determined in the billing document

The system can exclude conditions so that they are not taken into account during pricing.For example:

Material 4711 costs 150 USD. Some customers receive a discount of 10 USD per 100 pieces.

However, a specific customer can buy the material for 100 USD. Since this is a particularly good price, the customer should not also have a discount of 10 USD per 100 pieces. Therefore, this discount is to be excluded from pricing.

To create a condition exclusion procedure which will be determined in the billing document.

Assign the procedure to the pricing schema, and maintain copy control so that pricing is not copied from Sales Order.

To achieve this, copy the standard pricing to a ZXXXX Pricing.

Define new document pricing procedure in SM30 - V_TVKV for billing.

Assign new document pricing procedures to billing types in SM30 - V_TVFK_PR

Define the Condition Exclusion Groups in OV31.

Assign the Condition type for the Condition Exclusion Groups in OV32.

Assign the Billing Pricing Procedure in VOK8 for the Condition Exclusion Groups.

When billing document is being created just enter manually your new price and the pricing program logic will include only the higher price one, excluding the rest that are lower price.

Steps for creating a new or changing an existing Billing Document Types

Create/Change your Billing types configuration in VOFA.

Some of the IMG stuff are :-

1) To block automatic transfer of the billing document to accounting, mark the field.

Indicates whether the system blocks automatic transfer of the billing document to

accounting.

Indicates whether the system blocks automatic transfer of the billing document to

accounting.

During document processing, you can manually transfer blocked billing documents to

accounting by selecting:

accounting by selecting:

Billing -> Change -> Release accounting

2) Account determination procedure

3) Output determination procedure etc. ...

After customizing, use transaction VCHECKVOFA to check your configuration :-

1) Proforma billing types: If it is a proforma billing type, (VBTYP = U), the field must

be blank and the account determination procedure must be empty.

be blank and the account determination procedure must be empty.

2) Cancellation billing document types: : A check is made to see if the cancellation

billing document type has the right VBTYP. An F2 invoice, for example, (VBTYP 'M')

can only be canceled with billing type S1 with VBTYP 'N' . A billing type with

VBTYP '5' can only be canceled with the VBTYP '6' and vice versa.

billing document type has the right VBTYP. An F2 invoice, for example, (VBTYP 'M')

can only be canceled with billing type S1 with VBTYP 'N' . A billing type with

VBTYP '5' can only be canceled with the VBTYP '6' and vice versa.

3) Cancellation billing document type partner functions A check is made to see if the

cancellation billing document type partner functions are empty or if those that

correspond to the billing type used are empty.

cancellation billing document type partner functions are empty or if those that

correspond to the billing type used are empty.

Next, make sure that you maintain the copy control for the Billing Types:

Sales documents in VTFA

Target Source

e.g. F1 - Invoice OR - Standard Sales Order

F1 - Invoice ZOR - Your Sales Order

e.g. F1 - Invoice OR - Standard Sales Order

F1 - Invoice ZOR - Your Sales Order

Billing documents in VTFF

e.g. G2 - Debit Memo F1 - Invoice

G2 - Debit Memo F2 - Invoice

e.g. G2 - Debit Memo F1 - Invoice

G2 - Debit Memo F2 - Invoice

Deliveries in VTFL

e.g. F1 - Invoice LF - Delivery

e.g. F1 - Invoice LF - Delivery

F1 - Invoice ZOR - Your Delivery

Billing Block will not worked if you did not assign it

Define the possible block indicators in SM30 - V_TVFS and

allocate them to the billing types concerned in SM30

V_TVFSP.

V_TVFSP.

Your Billing Block will not worked if you did not assigned it to the desired billing types.

You can auto block by :- 1. sales document type in transaction VOV8, fields Billing Block, or 2. item categories in SM30 - V_TVAP, by filling the fields Billing Block.

Billing Plan for Milestone Billing

Milestone billing means distributing the total amount to be billed over multiple billing dates in the billing plan. As each milestone is successfully reached, the customer is billed either a percentage of the entire project cost or simply a pre-defined amount.During sales order processing, the system determines from the item category whether a billing plan is required and, if so, which type of plan The type of billing plan that is determined at this point is set up in Customizing and cannot be changed in the sales document. Billing plans for periodic billing and milestone billing plans for project-related milestone billing have different overview screens so that you can enter data relevant to your processing. For example, for milestone billing, you must be able to enter data to identify the individual milestones.

IMG configuration requires :-

1. Maintain billing plan types for milestone billing in OVBO.

2. Define date description in SM30 - V_TVTB

. 3. Maintain Date Category for Billing Plan Type IN OVBJ

. 4. Allocate date category in SM30 - V_TFPLA_TY.

5. Maintain date proposal for Billing Plan Type in OVBM.

6. Assign Billing Plan Type to Sales Documents Type in OVBP.

7. Assign Billing Plan Type to Item Categories in OVBR.

8. Define rules for determining the date in OVBS. Milestone billing is typically used for billing projects,

such as plant engineering and construction projects. Such projects often include a series of milestones that mark the completion of different stages of the work. In the SAP R/3 System, milestones are defined in a network along with planned and actual dates for the completion of work. The milestones are also assigned to the billing dates in the billing plan. Each milestone-related billing date is blocked for processing until the Project System confirms that the milestone is completed. Delivery-relevant order items for which a milestone billing plan applies are billed on the basis of the requested delivery quantity and not on the total of the confirmed quantities. The connection between the project and the sales document item is made in the individual schedule lines of the item. Each schedule item can be assigned to a network in a project. To display the project-related data for a schedule line, proceed as follows: In one of the overview screens of the sales document, select 1. Item -> Schedule lines. 2. Mark the schedule line and select Procurement details. The following figure shows an example of milestone billing where only the Contract have been billed : Order Item Turbine 100,000 Billing Plan Billing date Description % Value Billing Block Milestone Billing Status 01-10-94 Contract 10 10,000 - x x 01-03-95 Assembly 30 30,000 x x 01-04-95 Maintenance 30 30,000 x x 01-05-95 Acceptance 30 30,000 x x 01-06-95 Final invoice .. .. x Network/Activities Milestone Estimate Actual Assembly 01-03-95 01-03-95 Maintenance 01-04-95 Acceptance 01-05-95 For each billing date in a milestone billing plan, you can specify whether the billing date is: 1. fixed 2. always updated with the actual date of the milestone 3. updated with the actual date of the milestone, if the date is earlier than the planned billing date for the date

IMG configuration requires :-

1. Maintain billing plan types for milestone billing in OVBO.

2. Define date description in SM30 - V_TVTB

. 3. Maintain Date Category for Billing Plan Type IN OVBJ

. 4. Allocate date category in SM30 - V_TFPLA_TY.

5. Maintain date proposal for Billing Plan Type in OVBM.

6. Assign Billing Plan Type to Sales Documents Type in OVBP.

7. Assign Billing Plan Type to Item Categories in OVBR.

8. Define rules for determining the date in OVBS. Milestone billing is typically used for billing projects,

such as plant engineering and construction projects. Such projects often include a series of milestones that mark the completion of different stages of the work. In the SAP R/3 System, milestones are defined in a network along with planned and actual dates for the completion of work. The milestones are also assigned to the billing dates in the billing plan. Each milestone-related billing date is blocked for processing until the Project System confirms that the milestone is completed. Delivery-relevant order items for which a milestone billing plan applies are billed on the basis of the requested delivery quantity and not on the total of the confirmed quantities. The connection between the project and the sales document item is made in the individual schedule lines of the item. Each schedule item can be assigned to a network in a project. To display the project-related data for a schedule line, proceed as follows: In one of the overview screens of the sales document, select 1. Item -> Schedule lines. 2. Mark the schedule line and select Procurement details. The following figure shows an example of milestone billing where only the Contract have been billed : Order Item Turbine 100,000 Billing Plan Billing date Description % Value Billing Block Milestone Billing Status 01-10-94 Contract 10 10,000 - x x 01-03-95 Assembly 30 30,000 x x 01-04-95 Maintenance 30 30,000 x x 01-05-95 Acceptance 30 30,000 x x 01-06-95 Final invoice .. .. x Network/Activities Milestone Estimate Actual Assembly 01-03-95 01-03-95 Maintenance 01-04-95 Acceptance 01-05-95 For each billing date in a milestone billing plan, you can specify whether the billing date is: 1. fixed 2. always updated with the actual date of the milestone 3. updated with the actual date of the milestone, if the date is earlier than the planned billing date for the date

SAP Billing - Combine Billing for deliveries with different date

When using transaction VF04 or Billing (background), the date of the billing document (e.g. the current date) must be entered (In VF04 : settings, default data.)

In VF06 or background: variant with parametrization) to avoid an unwanted split due to the billing date.

This OSS notes is very helpful :-

11162 - Invoice split criteria in billing document

36832 - Invoice split in fields from the sales order

Billing Spilt by Item Category In trx VTFA (if your billing is sales order based) choose your billing type and SO type, there select your item categories and there select the field VBRK/VBRP data. In that field you will see the currently used routine. With the help of your ABAP guy create a copy of that routine under a different number and add your lines of code. Let's say you use routine 001.

FORM DATEN_KOPIEREN_001.

FORM DATEN_KOPIEREN_001.

* Header data

* VBRK-xxxxx = ............

* Item data

* VBRP-xxxxx = ............

* Additional split criteria

* VBRK-xxxxx = ............

* Item data

* VBRP-xxxxx = ............

* Additional split criteria

DATA: BEGIN OF ZUK,

MODUL(3) VALUE '001',

VTWEG LIKE VBAK-VTWEG,

SPART LIKE VBAK-SPART,

END OF ZUK.

MODUL(3) VALUE '001',

VTWEG LIKE VBAK-VTWEG,

SPART LIKE VBAK-SPART,

END OF ZUK.

ZUK-SPART = VBAK-SPART.

ZUK-VTWEG = VBAK-VTWEG.

VBRK-ZUKRI = ZUK.

ZUK-VTWEG = VBAK-VTWEG.

VBRK-ZUKRI = ZUK.

ENDFORM.

This is how it should look after modification:

* Header data

* VBRK-xxxxx = ............

* Item data

* VBRP-xxxxx = ............

* Additional split criteria

DATA: BEGIN OF ZUK,

MODUL(3) VALUE '001',

VTWEG LIKE VBAK-VTWEG,

SPART LIKE VBAK-SPART,

PSTYV LIKE VBAP-PSTYV, <- New line

END OF ZUK.

MODUL(3) VALUE '001',

VTWEG LIKE VBAK-VTWEG,

SPART LIKE VBAK-SPART,

PSTYV LIKE VBAP-PSTYV, <- New line

END OF ZUK.

ZUK-SPART = VBAK-SPART.

ZUK-VTWEG = VBAK-VTWEG.

ZUK-PSTYV = VBAP-PSTYV. <- New line

VBRK-ZUKRI = ZUK.

ZUK-VTWEG = VBAK-VTWEG.

ZUK-PSTYV = VBAP-PSTYV. <- New line

VBRK-ZUKRI = ZUK.

ENDFORM.

After this routine is created and activated place it as the default copy control routine instead of the old ones.

Maximum number of items in FI reached Message no. F5 727

If you hit the above erros when you create an invoice in SD, the corresponding accounting document is not created.

The error is as follows:

Maximum number of items in FI reached Message no. F5 727

Diagnosis

The maximum number of items for an FI document ('999') has been exceeded.System response

FI documents have a 3-digit item counter that limits the number of items permitted per document.

Procedure

If the documents with an excessive number of items come from another application area

(e.g. sales, logistics, order accounting), you can configure the system to the effect that

these documents are summarized in FI. "

How could this error be solved as none of your invoices are getting accounted in FI?

To overcome this, the only way was to break the accounting invoices, 1 with 950 items and the other with the rest.

Restricting Number Of Items In Billing Doc

You can restrict delivery with delivery tolerance, thereby causing invoicing of the desired.

o

Go toSPRO>>>IMG>>>Sales& Distribution>>>Billing>>>Billing Documents>>>Country-specific features>>>Maintain Maximum No. Of Billing Items.

This is where you can define a maximum number of items allowed for all billing documents within a given sales organization.

However, maintaining data here is not enough alone to bring about a billing split by number of billing items.

You must also go to copying control for order/delivery to billing document at item level under "Data VBRK/VBRP" and maintain routine 006 "individual invoice limited" or a similar routine that accesses the data maintained here.

Assign a Cost Center manually in a Sales Order (VBAK-KOSTL)

Taxation Explain with an example

When you enter the material number of a bill of materials that is relevant for sales order processing, the system displays the material that describes the whole bill of materials as a main item. The individual components are displayed as lower-level items.

If you want the system to carry out pricing, inventory control, and delivery processing at main item level, enter ERLA in the Item category group field of the Sales: sales org. 2 screen in the material master record of the finished product. This means that the components only function as text items and are not relevant for delivery. The following graphic shows how a bill of material is processed at main item level.

How to do rebate processing

SAP SD Tutorials and Pdf guides to download.Basic Process of how Packing Works

Default First Date is not Today

When end user created a new sales order with VA01, default First Date wasn't today, why?

Note:

1. Before today, default First Date was always today.

2. Nobody change system configuration.

1. Before today, default First Date was always today.

2. Nobody change system configuration.

Although you mention that nobody change the system configuration, it is very unlikely that the system will mis-behaved after one day.

Usually, after checking, you will find that someone have actually change the configuration as it could not be a software bug since you have been using it for quite sometime without any problems.

The date is control by each Sales Order Type for each Sales Document type whether is it a

- OR - Standard Order,

- RE - Returns etc.

- OR - Standard Order,

- RE - Returns etc.

Verify the Sales order type configuration with the following path:

IMG: Sales and Distribution --> Sales --> Sales Docs --> Sales Doc Hdr --> Define Sales Doc Types (transaction vov8) will let you control this by sales document type.

There is one field (Lead time in days) which "specify the number of days after the current date that the proposal for the requested delivery date in the sales document should be".

This should be blank if you want the system to propose current day for delivery date.

Auto proposed all the dates when creating Sales Order

How can I make the system auto create all the Sales Order date during creation?

Each Sales Order can have different date proposal settings.

Follows this step to set the default Sales Order Type proposal date:

- Goto VOV8, double click on sales order type.

- Look and tick the fields Propose delivery date and Propose PO date.

After making the necessary IMG changes, you need to input the Delivery Plant field for each Materials that you want the system to propose the default date.

To change the Materials field Delivery Plant:

Goto MM02, Select the View Sales: Sales Org. Data 1 and fill in the Delivery Plant.

Testing:

Now, try creating a new sales order for the material and SAP will auto proposed all the dates in the sales order

Define whether the Material can be used at which Sales and Distribution process

Here you define how the system responds when entering a sales and distribution document

with this material in the differenet Sales and Distribution Process Flow..

with this material in the differenet Sales and Distribution Process Flow..

You can use the material status, for example, to prevent orders from being entered for

parts to be discontinued.

parts to be discontinued.

OR

To temporary block the creation of Sales Order for a certain materials.

Set the material status parameters in transaction SM30, Table Views V_TVMS

The Cost Center Determination settings is in OVF3 - but there are some cases where the Cost Center must be exceptionally changed.

If the document category for order type in IMG VOV8 is defined to be "I" which belong to order type FD - Deliv.Free of Charge, then the field cost center is active for input during transaction VA01.

Alternatively, you can specify an order reason and assign a cost center to an order reason.

However the standard SAP works only at the header level though, so it would not work if cost center is needed on the line item.

The cost center are assign for such business transactions as :

- Free deliveries

- Returns

- Deliveries of advertising materials

- Returns

- Deliveries of advertising materials

You can also make cost center allocation dependent on the order reason, for example:

Order reason: Damage in transit

Order reason: Free sample

Order reason: Free sample

Both the IMG settings are done in transaction OVF3, either with/without the order reason.

Sales and Distribution - Transfer of Requirements

The MRP department is informed about the quantities and deadlines by which incoming orders should be delivered. The system checks the availability of the goods based on the requested delivery date of the customer and creates MRP records which contain all necessary information for passing on to planning. It ensures that the goods are available in time for the delivery. Materials planning transfers the reported requirements and creates orders or purchase requisitions from them etc.

For controlling transfer of requirements, you have to carry out the following steps: 1. Each requirement type has to be allocated to one requirement class only. 2. The transfer of requirements must be switched on at requirements class level, the sales documents at schedule line level. 3. You must define a check group. It is possible to have this check group proposed for the initial creation of a material master record. 4. Note that a plant must exist for transfer of requirements to be carried out at document item level. OVZG - Requirement class It specifies the following points: - whether an availability check and a transfer of requirements is carried out for a transaction (for sales documents, fine tuning using the schedule line category is possible), - whether the requirements are relevant for MRP, - the allocation indicator from the sales view which controls the settlement of customer requirements with requirements - whether an item is to be settled to an auxiliary account assignment, - the settlement profile, - the results analysis key. (Use transaction SM30 for V_* configuration) OVZH - Requirements type V_TVEPZ_V - Assignment of requirement type to Transaction V_TVEP_V - Schedule line category OVZ2 - Define Checking Group V_TMVFU - Define the checking group that the system proposes when you create a new material master record. You can overwrite the default value for the checking group in the material master record.

For controlling transfer of requirements, you have to carry out the following steps: 1. Each requirement type has to be allocated to one requirement class only. 2. The transfer of requirements must be switched on at requirements class level, the sales documents at schedule line level. 3. You must define a check group. It is possible to have this check group proposed for the initial creation of a material master record. 4. Note that a plant must exist for transfer of requirements to be carried out at document item level. OVZG - Requirement class It specifies the following points: - whether an availability check and a transfer of requirements is carried out for a transaction (for sales documents, fine tuning using the schedule line category is possible), - whether the requirements are relevant for MRP, - the allocation indicator from the sales view which controls the settlement of customer requirements with requirements - whether an item is to be settled to an auxiliary account assignment, - the settlement profile, - the results analysis key. (Use transaction SM30 for V_* configuration) OVZH - Requirements type V_TVEPZ_V - Assignment of requirement type to Transaction V_TVEP_V - Schedule line category OVZ2 - Define Checking Group V_TMVFU - Define the checking group that the system proposes when you create a new material master record. You can overwrite the default value for the checking group in the material master record.

Define Tax Determination Rules

You specify the valid tax types in transaction OVK1. More than one tax type can be defined for a country by defining the sequence.

The SAP System determines the taxes automatically within pricing.

In the standard SAP R/3 System, the elements of tax calculation are predefined (for example, tax condition type "MWST" for taxes on sales and purchases).

Assign the plant for Tax Determination in OX10, using the country key, the SAP System recognizes which tax type is valid for a plant and thus which taxes are relevant when creating an SD document.

Define the Customer Taxes in OVK3, you will maintain the tax code in Customer Master.

Define the Material Taxes in OVK4, which will then be maintain in Material Master.

For example :-

MWST GST 0 Tax Exempt

MWST GST 1 Liable for Taxes

MWST GST 0 Tax Exempt

MWST GST 1 Liable for Taxes

Now, you define the Tax Determination in VK12.

VK12 - Domestic Taxes/Export Taxes

Condition Type MWST

Customer Taxes Material Taxes Rate Taxes

0 0 0 %

0 1 0 %

1 0 0 %

1 1 9 %

0 0 0 %

0 1 0 %

1 0 0 %

1 1 9 %

In this example, if both the Customer Master and Material Master Tax code is 1, Tax will be included when you create the Sales Order.

Tax Code in Customer Master / Sales Order

How can we maintain the Tax Code (Tax code - which we maintain in MWST Condtion Records) in Customer Master or in Sales Order?

There are few points which I would like to remind you:

1) MWST is a tax condition which is applied to customer to whom we are selling. The rate of tax is depend on various parameteres, whether is fully liable for tax or expemted (in case of Defence Customer)

2) There are few parameteres which we apply tax condition. Whether customer is tax liable? Whether material is tax exempted?

For example, if you are selling a goods which are free for tax to any customer, put the Tax Indicator (at MMR as '0'). If your

material is tax liable pur the Tax Indicator (at MMR as 1). If your customer is not liable for tax at all (like the case of Indian

Defence organisations) put the Tax Indicator (at CMR as 0) or 1 in case fully tax liable.

material is tax liable pur the Tax Indicator (at MMR as 1). If your customer is not liable for tax at all (like the case of Indian

Defence organisations) put the Tax Indicator (at CMR as 0) or 1 in case fully tax liable.

3) Now, at VK11 you need to mainatain your pricning conditions with all the combinations like:

1 0

1 1

0 1

0 0

1 1

0 1

0 0

4) While maintaining your Material Master Records or Cusotmer Master Records, you must identify, which are tax liable and which are tax exempeted.

5) In anycase, as a SAP standard Best Practises, while processing a sales order, you must retrieve a Tax condition record from SAP database only and not entered Manually. Accordingly, at V/06, the MWST condition Defintions, the field for 'Manual Entries', it would be marked as - D (Not possible to process Manually).

Due to this setting, normally, you cannot maintain Condition tax code during sales order processing. And in Cusotmer Master, you can only maintain Tax Indicator and not Tax Code.

6) In case your client insists for Manual entry of Tax code during Sales Order processing, you can change the field at point 5) above to C-Manual entry is priority instead of D.

I'm assuming that, the country is India and based on its requirement:

Sales tax is a state government revenue. There are two types of sales taxes, Local sales tax & central sales tax. Local sales tax is intra state whereas CST is inter state.

Example of LST : Point of sale i.e. delivering plant & ship to party are within the same state. The rates are defined by the respective state governments.

Example of CST : The Delivering plant & Ship to party geographic locations are 2 different states. At the point of sales from one state, the ST goes to that state govt. & consignment is despatched to the Ship to party. Once that consignment is received at the ship to party state, sales tax will be levied once the sales is registered there. For this case, the LST that is applicable by the Ship to party further will not be applicable in all probability to be captured in SAP.

Stock transfer : This does not attract any sales tax. The consignment is transferred from one D plant to another D plant irrespective of inter/intra state sales. The invoice that is accompanied with the consignment thus shall not have any final value. It's a zero value invoice, but the basic prices needed to be mentioned.

The selling organisations normally needs to register with the sales tax authority of the respective state to have a warehouse or D plant to avoid the double taxation for their dealers/distributors.

Now, the pricing procedure that is there in 4.7 is Factory sale with formula-JFACT, in which the CST condition type is JIN1 & the LST is probably JIN2. There may be surcharge cond types as well which will calculate the amount on either JIN1 or JIN2.

For config :

1.SPRO > S&D > Basic fn. > Pricing > Pricing control > Define & assign Pric. procedure > Maintain Pric proc.

2. The tax rates are normally driven from the Tax classification of Customer & Material access. To do this config, S&D >Basic fn. > Taxes. You need to include the condition type for country IN in 'Define tax determin rule'.

3. Same path : But go to Tax relevancy of master records where you configure the condition type & options of rates that will flow to these masters. One needs to understand here properly as u need to have unique combinations for picking the sales tax rates. I will try to demonstrate the smallest example. Let's say, the LST rates are 2%,4% & 0%. I will have two options for material master here. 1 for taxable & 2 for not taxable.

For customer master, I will have 1-LST 2%, 2-LST4% & 3-LST0%. When I create master records for LST thru VK11 for JIN2, I will chose the access where the combinations of customer & material tax classifications are available. If this access does not exist create it under an access sequence. But normally this is standard. The condition records will look like,

Cust-Tax classi. Material tax claasi. Rate Tax code

1 1 2% A1

2 1 4% A1

3 1 0% A1

Cust-Tax classi. Material tax claasi. Rate Tax code

1 1 2% A1

2 1 4% A1

3 1 0% A1

Remember, rates are flown from the tax codes. Tax codes can be created thru T code FTXP. This is normally a FI job.

SAP SD: Scheduling Agreement Vs Contract

A schedule agreement contains details of a delivery schedule but a contract just contains quantity and price information and no details of specific delivery dates

What's the difference between schedulling agreement with normal order?

What's the condition for us to choose schedule line or order?

What's the condition for us to choose schedule line or order?

Both of them contains schedule line, price, quantity.

There are a couple major differences:

(1) - Schedule agreements allow you to have 2 different sets of schedule lines (VBEP-ABART). Standard SAP you should have two sets of tabs - of schedule lines. One Forecast & the other JIT. Forecast forwards the schedule lines to planning (seen in MD04) and JIT passes them to shipping (VL10). They can be identical or different. Typically these are used for component supplier customers (namely Automotive). The customer will provide you 4-10 weekly buckets (usually a

Monday date) of future forecast qtys. Also send you 1-2 weeks of individual FIRM ship dates - which are entered on the JIT. It comes down to the customer not knowing exactly what they need next week, but they don't want to suprise you with a large order qty, where your lead times are 5+ days. The forecasted qtys they sent last week should account for this.

Monday date) of future forecast qtys. Also send you 1-2 weeks of individual FIRM ship dates - which are entered on the JIT. It comes down to the customer not knowing exactly what they need next week, but they don't want to suprise you with a large order qty, where your lead times are 5+ days. The forecasted qtys they sent last week should account for this.

(2) Cumulative Quantities are tracked and influence how the schedule agreement passes requirements to both forecasting and shipping. These qtys are sometimes requested by the customer on ASNs. Cumulative qtys reset at year end unless you've got a customer calendar or you've modified standard SAP userexits to not reset.

Schedule agreements are very nice when the customer sends EDI data (830s = forecast or 862s = JITs). Outside of that they can really cause trouble regarding daily maintenance, missing requirements, cum qty corrections, year end processing, etc.

One alternative would be to use customer independent requirements - entering the weekly, monthly forecasting qtys and entering standard sales orders (with or without multiple schedule lines) to represent the true firm qtys.

Sales BOM Implementation

A bill of material (BOM) describes the different components that together create a product. A BOM for a bicycle, for example, consists of all the parts that make up the bicycle: the frame, the saddle, wheels, and so on.

Process Flow

When you enter the material number of a bill of materials that is relevant for sales order processing, the system displays the material that describes the whole bill of materials as a main item. The individual components are displayed as lower-level items.

There are two ways to process a bill of materials in Sales. Once you have entered a bill of material in a sales order, the system runs pricing, inventory control, and delivery processing at:

- Main item level if the material is assembled, or